Things about Loss Adjuster

Table of ContentsAll about Property DamageThe Greatest Guide To Loss AdjusterAll About Loss AdjusterExamine This Report about Loss AdjusterGetting The Property Damage To WorkProperty Damage Things To Know Before You Buy

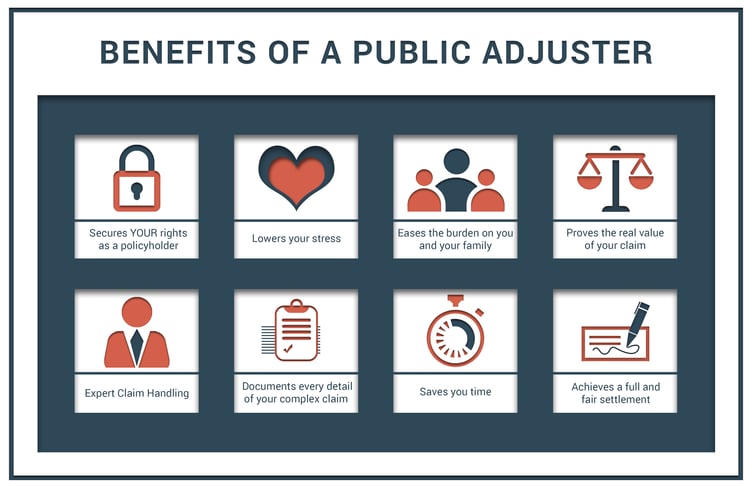

If you wish to make sure that you get all the benefits offered by your insurance plan and also the largest settlement possible, it's worth calling a public insurance policy insurer today! They are professionals that function to get you the very best negotiation feasible from your insurance firm. They can help determine what is as well as isn't covered by your policy, as well as they will manage any kind of disputes or negotiations on your behalf.There are special sorts of insurance coverage case adjusters: The insurance holders themselves as well as not the insurance company work with public insurance adjusters. Outdoors adjuster contracted by the insurance provider. Generally from large corporations that agree to the insurance provider's pre-set procedures. Personnel insurers are employed by the insurer. They are either outside service providers or regularly function within the business itself (loss adjuster).

So out of all the courses of insurance policy claim insurers, public insurers are the just one that are independent of insurer (public adjuster). They are hired by the insurance policy holder to go over the case and to ensure that they obtain the proper amount of money. The goal is to obtain the insurance policy business to cover the whole damages or loss to their structures or residential property from a disaster or crash.

The Ultimate Guide To Public Adjuster

They were placed into location to make sure that insurance provider would certainly pay all claims from clients and also not attempt to reduce costs by underpaying for an insurance claim or rejecting it entirely. The public adjuster's task is simple: they look over your policy, determine what you are owed, and afterwards fight in your place to get the full negotiation.

If you have a home mortgage, the lien owner also will certainly be a payee, as will certainly any kind of other events with insurable passions. A public adjuster works as your rep to the insurance provider. Their purpose is to navigate all stages of the claim procedure as well as supporter for the ideal passions of the insured.

Loss Adjuster - Truths

This allows the guaranteed to concentrate on other, a lot more crucial tasks instead of taking care of the stress of insurance policy arrangements. This is especially handy in the days and also weeks complying with a loss. There are various tasks that public insurance adjusters do for the insurance policy holder: Determine Coverage: Evaluate as well as analyze the insurance coverage and determine what protection and limitations use.

Some insurance coverage adjusters have more experience as well as will certainly do a better task. It's always practical to request references or to see a listing of to evaluate the insurance adjuster's ability. Not all insurance coverage declares adhere to a set path. There are constantly distinctions as well as problems that have to be navigated. A proficient insurer requires to show 3 points: Loss conditions meet the criteria for coverage.

Things about Loss Adjuster

That the negotiation quantity will completely bring back the insurance policy holder's residential property to pre-loss problem. Any pointer that verifying these points is easy, or that a computer system can do it for you, simply isn't real. Claims really rapidly become a twisted mess because the: Loss problems are not plainly try these out mentioned, not correctly evaluated as well as recorded, or they consist of numerous reasons or a number of policies.

The negotiating procedure begins as quickly as you sustain a loss. In the event of a loss, it is essential to be prepared and have all your documentation available. If the loss is significant, you might wish to reach out to a public insurance insurer first. You ought to inform your insurance firm as soon as possible.

Understand that they will be evaluating exactly how much you understand about your plan restrictions, the problems you have actually endured as well as if you are looking to an agent, public insurance adjuster or insurance service provider for guidance. A public insurer breaks the analysis cycle, actioning in as your unique specialist agent. With an equal opportunity, whole lots of paperwork, and also iron-clad evidence of all appraisals, it is challenging for the insurance policy company to suggest for anything much less than a full and reasonable negotiation.

What Does Public Adjuster Mean?

All we can do is share what we have won for customers. The chart below reveals a few of the much more moderate cases that we've assisted to work out. As you can see in every circumstances we gained our customers a minimum of dual the amount of the original insurance business offer. This Chart of Current Recoveries reveals simply a few of the over here negotiations that we have actually assisted to win.

Keep in mind that there is a lot at stake, and also the insurer has great deals of experience in controlling end results. It's very easy for emotions to run hot, especially when you're the one with whatever to shed. If generated early, a qualified public insurer can become the equalizer for you. When disagreements occur, your public insurance adjuster will certainly recognize what to do and also work to settle the issue successfully.

If the loss is significant, you might want to reach out to a public insurance coverage adjuster. You should notify your insurance firm as soon as feasible.

Indicators on Public Adjuster You Need To Know

The chart listed below reveals some of the a lot more modest insurance claims that we've aided to resolve. As you can see in every circumstances we gained our clients at the very least dual the amount of the original insurance coverage business offer.

Keep in mind that check this site out there is a great deal at stake, as well as the insurance policy business has great deals of experience in managing outcomes. It's easy for emotions to run warm, especially when you're the one with everything to shed. If brought in early, a certified public insurance adjuster can become the equalizer for you. When conflicts arise, your public insurance adjuster will know what to do and also function to settle the problem effectively.